XRP Price Prediction: Technical Consolidation Meets Fundamental Growth Catalysts

#XRP

- Technical indicators show consolidation with bullish MACD signals suggesting building upward momentum

- Fundamental expansion through African stablecoin deployment and aviation partnerships provides strong adoption catalysts

- Regulatory clarity remains the critical variable that could accelerate or hinder price appreciation toward projected targets

XRP Price Prediction

Technical Analysis: XRP Shows Consolidation Pattern Near Key Moving Average

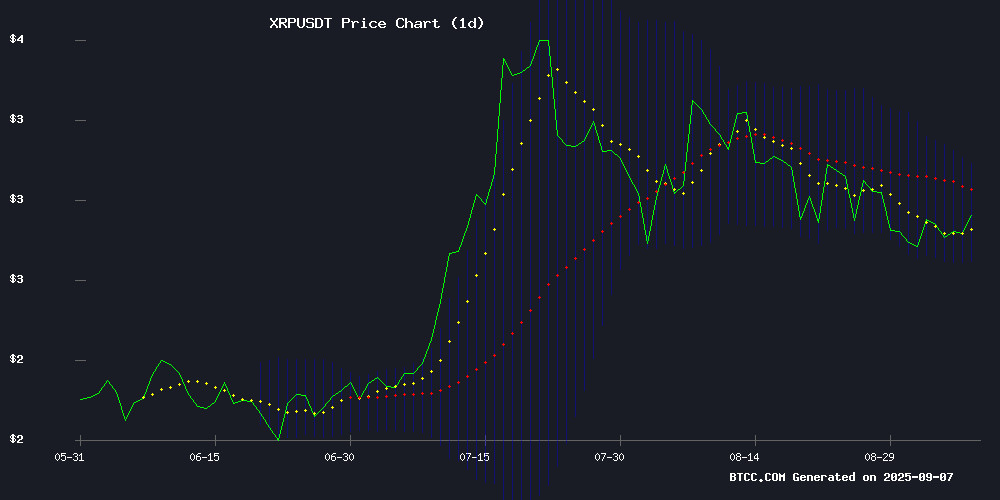

XRP is currently trading at $2.8447, slightly below the 20-day moving average of $2.8880, indicating a period of consolidation. The MACD indicator shows a bullish crossover with values of 0.1247 (MACD line) and 0.1195 (signal line), while the histogram reads 0.0051, suggesting modest upward momentum. Bollinger Bands position the price between the upper band at $3.0768 and lower band at $2.6993, with the middle band aligning with the 20-day MA. According to BTCC financial analyst Ava, 'The current technical setup suggests XRP is building a base around the $2.85 level, with the MACD crossover providing tentative bullish signals. A break above the 20-day MA could trigger movement toward the upper Bollinger Band around $3.08.'

Market Sentiment: Institutional Demand and Expansion Drive Long-Term Optimism

Market sentiment for XRP remains cautiously optimistic despite short-term pressures. Positive developments include expanding institutional adoption through Ripple's RLUSD stablecoin expansion in Africa, partnerships with major companies like Webus and Air China targeting 60 million loyalty users, and growing adoption in payments, DeFi, and NFTs. However, regulatory challenges and questions about bank adoption present headwinds. BTCC financial analyst Ava notes, 'The fundamental backdrop supports long-term growth with concrete adoption milestones, though regulatory clarity remains the key variable. Institutional demand appears to be providing stability during consolidation periods.'

Factors Influencing XRP's Price

XRP Price Stability Bolstered by Institutional Demand, Says Digital Ascension CEO

XRP's market structure has evolved to prevent another 90% collapse, according to Jake Clover, CEO of Digital Ascension Group. Institutional participation through ETFs and algorithmic trading has created sustained demand, fundamentally altering the asset's volatility profile.

"When it was 50 cents, nobody wanted to buy it... You had three years to accumulate at those levels," Clover noted in a September 3 address. The cryptocurrency's prolonged consolidation phase between $0.30-$0.50 established a firm base, with current institutional inflows providing additional support.

Market mechanics now differ significantly from previous cycles. Execution algorithms and regulated products absorb sell pressure, while traditional accumulation strategies appear obsolete. "Those windows have closed," Clover emphasized regarding deep discount opportunities.

Ripple’s XRP Faces Short-Term Pressure Amid Long-Term Optimism

XRP hovers at $2.81, caught in a crypto market paralyzed by low volumes and indecision. Technical indicators flash conflicting signals—short-term selling pressure clashes with long-term moving averages hinting at potential support. The Relative Strength Index (49) and Stochastic (44) reflect a market devoid of conviction.

Analysts scrutinize volume as the decisive factor for XRP’s next move. A rebound scenario hinges on renewed buying interest, while stagnant trading activity could prolong the stalemate. The token’s 2017 bull run remains a distant memory as current price action mirrors broader market fragility.

Investors weigh caution against opportunistic accumulation. Ripple’s legal clarity and institutional adoption prospects offer a counterbalance to near-term technical weakness. The 100- and 200-period moving averages emerge as critical battlegrounds for directional confirmation.

XRP Adoption Surges: Expanding Payments, DeFi, and NFTs

XRP, the native token of the XRP Ledger, is rapidly evolving beyond its roots in cross-border payments. The ecosystem now spans decentralized finance (DeFi), real-world asset tokenization, and NFT platforms, attracting both institutional and retail interest. Its near-instant settlement times and minimal fees continue to make it a preferred choice for global value transfer.

Attorney Bill Morgan recently highlighted the efficiency of bridge currencies like XRP, underscoring their advantage over traditional payment rails. The XRP Ledger's versatility positions it as one of the most influential Layer 1 blockchains, with growing use cases cementing its relevance in digital finance.

Ripple Expands RLUSD Stablecoin in Africa via Fintech Partners

Ripple is extending the reach of its RLUSD stablecoin into Africa through strategic institutional partnerships, targeting cross-border payments and digital finance. African businesses, increasingly in need of efficient global settlement solutions, are turning to RLUSD as a regulated alternative to dominant stablecoins like Tether (USDT) and USD Coin (USDC).

The initiative integrates RLUSD into regional financial systems via collaborations with fintechs and payment providers. Ripple's push aligns with its broader strategy to bridge financial infrastructure gaps using blockchain technology, particularly in underserved markets.

Launched in 2024, RLUSD is a NYDFS-approved, USD-backed stablecoin on the XRP Ledger. It has rapidly surpassed $1 billion AUD in supply, emerging as a top contender in the sector. Regulatory compliance remains its cornerstone, offering institutions a transparent and credible settlement option that adheres to global standards.

Could XRP Be Managed Like Oil?

XRP, the cryptocurrency known for its legal battles and utility in payments, is now being compared to oil in terms of market management. Analyst Brad Kimes suggests Ripple's escrowed reserves could function like OPEC's strategic oil reserves, stabilizing XRP's price volatility.

The analogy draws parallels between oil's supply-demand mechanics and Ripple's potential to regulate XRP's circulation. With XRP already serving as a store of value and medium of exchange, its evolution into a unit of account hinges on broader adoption and regulatory clarity—mirroring the dollar's post-WWII ascent.

XRP Enters Aviation: Webus, Air China Target 60M Loyalty Users

XRP's mainstream adoption accelerates as Webus International Ltd. partners with Air China Ltd. to integrate cryptocurrency payments into the Phoenixmiles loyalty program. The collaboration opens blockchain-based settlement and tokenized rewards to over 60 million members, signaling a strategic shift toward Web3 in global travel.

Webus confirmed its Wetour platform will provide premium airport services for Air China passengers, with XRP payments embedded in the ecosystem. This marks one of the first large-scale airline adoptions of blockchain financial infrastructure. Nan Zheng, CEO of Webus, framed the deal as a step toward a "Ripple-integrated travel ecosystem."

The aviation industry's embrace of digital assets highlights their utility beyond finance—streamlining cross-border settlements, enhancing loyalty programs, and improving payment efficiency in a sector where these factors are critical competitive advantages.

XRP Price Prediction: Analyst Projects $473K Target Amid Tokenization Boom

Crypto analyst Costa has unveiled an audacious forecast for XRP, suggesting the asset could reach $473,214 per token if 10% of global assets migrate onto the XRP Ledger by 2030. The projection hinges on Ripple's estimate that $50 trillion in real-world assets may be tokenized this decade.

The analysis posits that every $10 billion of XRPL inflows could multiply XRP's market cap by 516x, potentially creating a $5.3 trillion valuation. "This level of tokenization would create unprecedented demand for XRP," Costa noted, emphasizing how utility-driven scarcity might trigger historic price appreciation.

While speculative, the prediction underscores growing institutional interest in blockchain-based asset representation. The XRP Ledger's technical capabilities position it as a potential infrastructure layer for this financial transformation.

XRP Price Prediction: Ripple Eyes $3.20-$3.50 Breakout Amid Consolidation

XRP is consolidating near the $2.81 support level as traders anticipate a potential breakout toward the $3.20-$3.50 range. Analysts remain cautiously optimistic, with short-term targets set at $3.05-$3.15 and medium-term forecasts projecting a 25% rally. Key resistance lies at $3.05, while critical support holds at $2.70.

Bullish forecasts, including projections from Elon Musk's Grok AI and Standard Chartered, suggest XRP could reach $3.50-$4.20 or even $5.50 by year-end 2025. Conservative views emphasize the need for XRP to reclaim $3.05 resistance before upward momentum resumes. Bearish outliers warn of a potential retracement to $2.40-$3.10 if support levels falter.

Ripple Targets Africa for RLUSD Stablecoin Expansion Amid Tether Dominance

Ripple is aggressively positioning its US dollar-backed stablecoin, RLUSD, as a viable alternative to Tether's USDT in Africa. The blockchain firm has partnered with fintech players Chipper Cash, VALR, and Yellow Card to enhance accessibility across the continent.

The initiative focuses on payments and settlements in regions with fragile financial infrastructure. RLUSD is already being deployed in social impact projects, including climate-related solutions in Kenya. Smart contracts automate drought and rainfall insurance payouts to farmers, demonstrating utility beyond speculative trading.

"RLUSD is gaining institutional traction for payments, tokenization, and collateral," said Jack McDonald, Ripple's SVP for stablecoins. Demand is growing globally among both crypto-native and traditional financial players.

XRP Price Prediction: Regulatory Catalysts and Whale Activity Shape Market Trajectory

XRP stands at a pivotal juncture as regulatory decisions and whale-driven volatility intersect with technological upgrades on the XRP Ledger (XRPL). The SEC faces a critical deadline in mid-to-late October 2025 to rule on spot XRP ETF applications from Grayscale, 21Shares, and others. Analysts estimate a 70–90% approval probability, citing Ripple's legal clarity as a decisive factor. Approval could trigger $4.3B–$8.4B in institutional inflows, echoing Bitcoin's 120% post-ETF rally in 2023.

Whale activity adds another layer of complexity. Wallets holding 1M+ XRP control 79% of the supply, creating outsized price influence. Exchange inflows from these large holders often precede market-moving volatility. Meanwhile, XRPL infrastructure improvements and Ripple's RLUSD stablecoin adoption provide fundamental support, offering a hedge against regulatory setbacks.

SWIFT CIO Questions Bank Adoption of XRP Amid Ripple's Regulatory Challenges

SWIFT's Chief Innovation Officer Tom Zschach has cast doubt on the likelihood of banks adopting XRP, citing concerns over governance and regulatory enforceability. The comments emerged during a LinkedIn discussion where Zschach argued that surviving lawsuits—a reference to Ripple's partial victory against the SEC—does not equate to institutional trust.

Zschach emphasized that financial institutions prioritize neutral, jointly managed infrastructures with legal enforceability. "If tokenized deposits and regulated stablecoins scale," he questioned, "why would banks pay a toll to an external asset when they can settle directly in instruments they already control and trust?" The remarks have fueled skepticism among XRP critics while underscoring the broader tension between traditional finance rails and crypto-native solutions.

How High Will XRP Price Go?

Based on current technical indicators and fundamental developments, XRP appears positioned for potential upward movement toward the $3.20-$3.50 range in the near term. The current price of $2.8447 sits just below the 20-day moving average, with bullish MACD signals suggesting building momentum. Fundamental catalysts including African expansion, aviation partnerships, and growing institutional adoption provide strong support.

| Indicator | Current Value | Significance |

|---|---|---|

| Current Price | $2.8447 | Below 20-day MA, consolidation phase |

| 20-day MA | $2.8880 | Key resistance level to watch |

| MACD Signal | Bullish Crossover | Positive momentum building |

| Bollinger Upper | $3.0768 | Near-term target resistance |

| Projected Range | $3.20-$3.50 | Breakout target with momentum |

BTCC financial analyst Ava emphasizes that 'while short-term consolidation continues, the combination of technical bullish signals and strong fundamental adoption stories suggests a breakout above $3.00 could open the path toward higher targets. Regulatory developments remain the primary wildcard.'